2024 Marijuana Tax Revenue by State (Map)

Usually, when marijuana tax revenue by state is discussed, two questions are bound to arise:

- How much money are we talking about?

- And where does all that money go?

In this article, we’re going to answer both of them.

As a matter of fact, state taxes are often used as the main argument in the fight for more recreational weed states. And to no surprise seeing how the (legal) cannabis market size in the US was worth an astonishing $13.6 billion in 2019 and another $16.1 billion in 2020. In 2021, $25 billion were spent on cannabis.

Best of all, it just keeps on growing — about 33% in the last year! Check the figures below to see for yourself!

How Much Marijuana Tax Revenue Can We Expect?

If we bear in mind the size of the US cannabis market, the figures are beyond impressive. Here, let’s name a few:

- The global CBD industry is expected to reach $3.52 billion for the 2020–2024 period.

- US sales of CBD and hemp oil products reached $238 million in 2018.

- The CBD oil market will be worth $2.17 billion by 2023.

- 59% of cannabis users consume it at least once a week.

- 55 million Americans (around 17% of the entire US population) use cannabis regularly.

- By 2022, cannabis-infused drinks will make 20% of the overall US cannabis edible market.

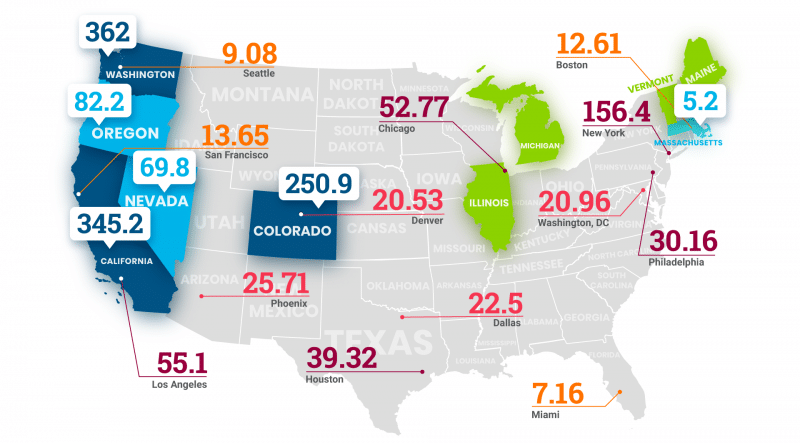

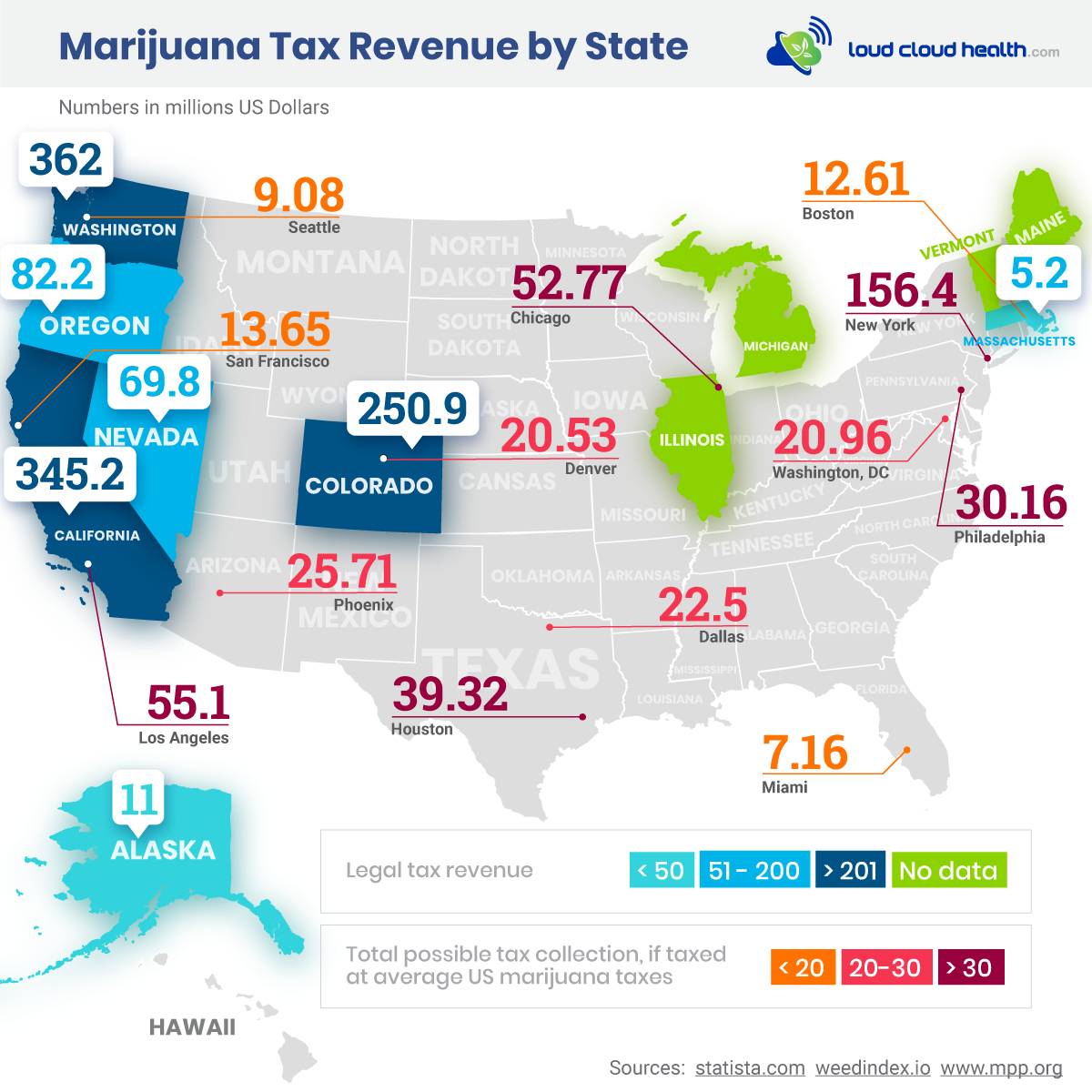

In the states where weed is legal for recreational or medical purposes, marijuana tax revenue by state in 2022 looks like this:

On the other hand, in states where weed is not legal, the estimates are based on the average marijuana tax. Namely, cannabis taxes vary greatly across states.

For instance, the highest cannabis taxes are in Washington — a staggering 37%! Oregon is next in line with 17%, whereas California and Colorado follow suit with 15% each. Likewise, Maine and Nevada share fifth place with 10% each.

Is Colorado Marijuana Tax Revenue Really That Big?

The tax revenue that has definitely attracted the most attention comes from the state of Colorado. The figure is truly impressive — the Centennial State has collected over $2 billion in tax revenues from cannabis from the moment its recreational cannabis legislation was signed back in 2012.

Consequently, the average monthly income has never gone below $20 million since 2017. For example, the Colorado total tax revenue from 2018 exceeded $266.5 million. That said, the very first month wasn’t all that promising with a “mere” $3.5 million.

Joining the states with legal weed was one of the best decisions Colorado could have made. Now, there are over 40,000 people working in 3,000 licensed cannabis businesses. Hence, it’s not all about the Colorado state tax and its application. Legalization also means high employment rates — in other words, it provides a direct boost to the economy, as well.

Overall, California is the current leader with $778 million in tax sales, whereas Washington state taxes take second place with $459 million in revenue from cannabis alone.

What Can Be Done With Tax Revenue From Weed?

Healthcare, education, drug abuse prevention, and law enforcement all get their fair share at the moment. However, each state’s legal body decides on the exact distribution for that state.

For example, if we take a look at one of the biggest revenue makers, Colorado — which hit a record in 2020 by helping the state collect $387 million in taxes — has so far spent 31.7% on human services, public health, and environment (20.7%), while education and local affairs got about 16.4% each.

In addition to that, Illinois marijuana tax revenue reached over $175 million from recreational marijuana sales through December 2020, of which 35% is planned to go to the General Fund. Likewise, 25% should cover community development, while 20% will be used for mental health and substance abuse prevention and treatment.

However, due to the global pandemic, the state of Illinois wasn’t able to award the planned 75 recreational marijuana store licenses, and the process will be postponed for 8 months.

Washington, which witnessed a 42% growth in sales of legal marijuana in 2020, spends almost half of its marijuana revenue on healthcare. Additionally, 40% of Oregon’s marijuana tax revenue went to education, while healthcare received 25%.

In general, the advantages of the financial boost are felt on the state and local levels.

Potential Issues

California weed taxes are a bit of a cautionary tale. Namely, the state’s weed revenue wasn’t large enough in July 2018 to cover youth education programs — the accumulated $44.4 million didn’t suffice.

In short, the problem arose from the fact that marijuana tax revenue by state has to be analyzed by a sufficient number of regulatory bodies — hence the administrative costs of $27.6 million. As a result, there wasn’t enough funding for youth education and prevention. In 2019, though, the tax revenue increased to $345.2 million.

On the other hand, some states end up with more US tax revenue than they anticipated. For instance, in 2020, California marijuana tax revenue hit a record number in marijuana sales and taxes, earning a mind-blowing $778.2 million!

Therefore, it is advisable that the states set some money aside for the rainy days. Despite the fact that legal weed states can earn huge profits, they are not 100% guaranteed.

On a more positive note, based on the current medical marijuana tax revenue by state predictions, Minnesota, Virginia, and New York will explore the possibility of allowing smokable flowers in 2021. This alone would result in $330 million in medical cannabis sales.

How Many States Have Legalized Weed?

At the moment, 34 states have legalized medicinal cannabis, whereas Arizona, Montana, New Jersey, and South Dakota have just joined the crowd of recreational weed states.

What’s more, the following 11 states (District of Columbia included) are looking forward to their tax revenue from marijuana: Washington, Colorado, California, Alaska, Maine, Michigan, Nevada, Oregon, Vermont, Illinois, and Massachusetts.

Nevertheless, that does not mean that you can light up a joint at any public place in these 11 states. Each one has its own laws regarding cannabis, so you had better study them properly before going all-in and blazing and shouting “420” in public!

And last but not least, on December 4, 2020, the US House of Representatives passed the MORE Act (removing cannabis from the list of scheduled substances), which will have a profound influence on the future of cannabis reform.

State of Legal Marijuana Tax Revenue in 2021

The global pandemic left a considerable impact on the world economy, mainly due to the many stores closing as the result of the lockdowns. However, there was still a huge increase in tax sales of marijuana in Fairbanks, Alaska, due to the COVID crisis, as well as the high demand for cannabis products.

There was a 30% growth in sales, compared to 2019, and the total revenue in the first six months reached $820,000. For example, Alaska marijuana tax revenue included the following taxation: bud and flower ($50.00 per ounce), immature bud ($25.00 per ounce), trim ($15.00), and clones ($1.00), which resulted in $24,5 million in total tax revenue.

What’s more, the governor of New York, Andrew Cuomo, plans to legalize recreational marijuana to plug the budget deficit. Namely, he believes that legal marijuana revenue alone would generate over $300 million in taxes. As such, his plan includes establishing a new Office of Cannabis Management that would be responsible for marijuana and hemp industry regulation.

In addition to that, he proposes three types of recreational marijuana tax revenue. The first one would be based on THC content, the second one would include a 10.25% of surcharge tax, and the third one would apply to local and state sales taxes.

And according to a new study, released by the New Frontier Data, full cannabis legalization in all 50 states would result in 1 million new jobs and $105.6 billion in federal tax revenue by 2025.

The Bottom Line

How to make the most out of cannabis legalization? Washington’s marijuana tax revenue is the highest in the country, as well as its tax rates. Does that mean that all the other states should follow suit?

Arguably, cannabis businesses still need a lot of support to thrive, especially due to the fact that they’re not yet eligible for bank loans. Marijuana taxes are without a doubt bringing benefits to the states so we hope they are also in good service to the businesses as well.

FAQs

When did income tax start?

The first income tax, and the first version of the IRS, was created during the American Civil War. The corporate income taxes were ratified in 1909, whereas the federal income taxes were officially approved in 1913. Other meaningful taxes include estate taxes (ratified in 1797 for the needs of the US Navy), gift taxes (1924), and sales taxes (starting with West Virginia in 1921).

When it comes to marijuana, its taxation started with the Marihuana Tax Act of 1937. Before that, there were no taxes or federal restrictions on marijuana and cannabis extracts. As a matter of fact, various cannabis products (tinctures and extracts) were used in Europe and the US before 1937.

How do dispensaries pay federal taxes?

Despite still being federally illegal, marijuana dispensaries still need to pay the taxes and report all transactions to the IRS. That said, if they can’t pay the full tax amount, dispensaries can apply for two options: payment plan and temporarily delay collection.

The penalties for unpaid taxes are the same as with other businesses. Those include additional taxes for late payments, accuracy-related penalties, etc. Keep in mind that marijuana dispensaries aren’t entitled to conventional deductions. Nevertheless, based on the marijuana tax revenue by state, dispensaries can get tax relief by calculating the expense of the products.

Would be great if Indiana would follow the trend and legalize!!!!

wish someone would update the map!1

Fear not, the updates are coming in soon enough :).

The taxes derived from the huge amounts of sales need to be looked at and dispersed to help the taxpayers from being taxed to death ie Schools, law enforcement and property taxes…what the heck are the states doing with this ,oney that they are not publicly accounting for?????

Sadly, not all states publicly disclose marijuana revenue spending. If you are from Colorado, you can take a look at where the money is distributed to here: https://docs.google.com/spreadsheets/d/1e8hnG64Vkg9ffgkNpKQ1kzPsXNbGjG2X/edit#gid=1168188338.